Crypto tax calculation service Recap has released the Recap Dashboard, providing UK investors with a single view of their crypto portfolio.

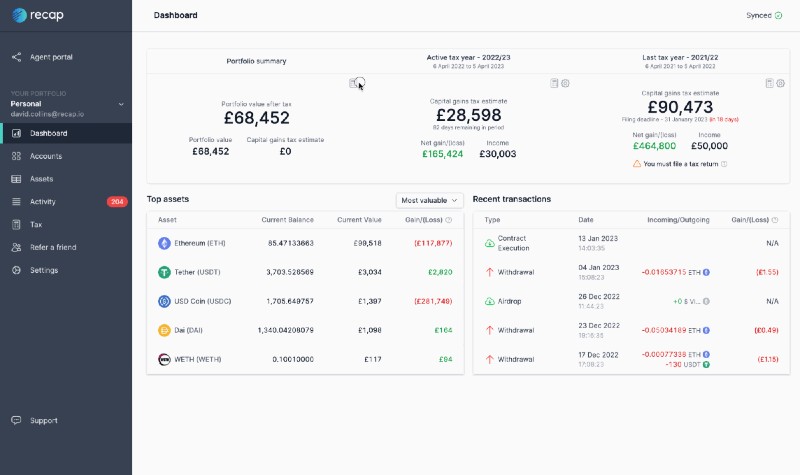

The Recap Dashboard provides users with a comprehensive overview of all their assets, transactions and tax estimations in one place.

“For investors, it’s easy to disconnect your taxes and your crypto portfolio, seeing the two as separate financial entities,” said Daniel Howitt, CEO and co-founder of Recap.

“Through our latest updates and the introduction of our new dashboard, Recap draws the two back together, allowing investors and accountants to proactively manage both assets and tax affairs in unison.”

The UK-focused dashboard delivers three distinct figures, pulling together a tax estimate for the prior tax year and current tax year, alongside a users’ crypto-net-worth – the users so-called ‘true’ value after tax.

With automated portfolio tracking and HMRC compliant tax exports removing barriers, investors are free to manage their assets without the headaches of understanding the complexities around taxation, the firm says.

“As Rishi Sunak campaigns for Britain to become a global hub for cryptoasset technology, crypto tax guidance remains foggy. Currently shoe-horned into existing rules and regulations, taxing cryptocurrency remains complicated and difficult to understand,” continued Howitt.

“Recap helps investors navigate the confusion – helping investors to understand, plan and proactively manage their digital wealth. With this in mind, our dashboard brings the figures you need to know about to the forefront, making cryptocurrency tax simple and self-explanatory.

“With a keen eye on the bigger picture, investors can look to reduce their tax payout, tactfully disposing of depleting assets to lower the tax figure. With greater autonomy and understanding, future planning and investments are better informed and the dream of six figure assets is a little more attainable.”