Crypto brokerage eToro has raised $250 million of funding eight months after scrapping a SPAC listing.

The merger with specially created shell FinTech Acquisition Corp V, which would have valued the company at $8.8 billion, was called off last July.

The new funding, which includes ION Group, SoftBank Vision Fund 2, Velvet Sea Ventures and a number of existing investors, values it at $3.5bn and was pre-agreed as part of the original SPAC agreement.

eToro also revealed its results for 2022, with total commissions of $631m and funded accounts of 2.8m, the latter up 17% year-on-year.

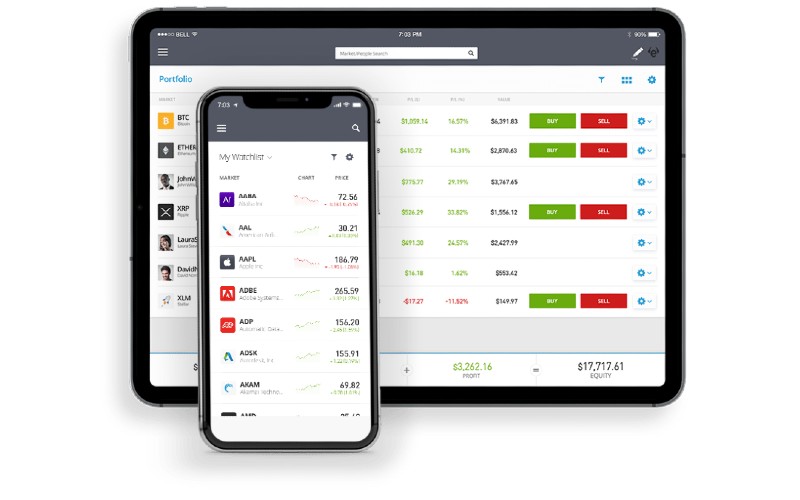

It said the commissions by asset class were 48% equities, 27% commodities, 19% cryptoassets and 6% currencies.

“We need no reminder that markets are cyclical,” said CFO Meron Shani. “The diversified nature of our multi-asset product offering ensured that commissions from equities and commodities partially offset the decrease in commissions from cryptoassets in 2022.

“It’s also worth noting that we were not impacted by the liquidity concerns which plagued many in the crypto industry. Our underlying business is profitable and our balance sheet is strong.

“Total commissions were down versus our stellar performance in 2021, yet up 5% versus 2020. We continued to grow our user base despite more negative market sentiment and a reduction in our marketing spend.”

eToro secured registrations in France and Italy, as well as a licence in New York and an approval in principle to operate in Abu Dhabi.

“As Q1 progresses, I’m hopeful that Yale Hirsch’s market theory ‘as goes January, so goes the year’ holds true. We’ve seen a positive start to the year with markets reacting favourably to ‘less bad’ news and retail trading hitting an all time high,” said founder and CEO Yoni Assia.

“I am very proud of the success with which we navigated 2022, continuing to grow our user base and enhance our product offering. Our 2023-2025 strategy focuses on scaling our brokerage business in our key markets and increasing profitability via revenue growth and cost management.”