The founder of the collapsed Terra blockchain has said he is “heartbroken” after the LUNA cryptocurrency and its sister stablecoin UST lost practically all their value in just a week.

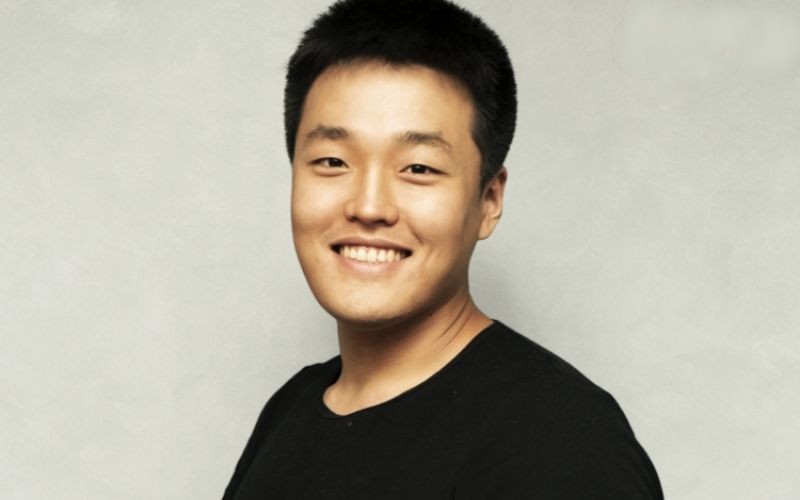

Do Kwon, founder of Terraform Labs – which powers the Terra blockchain – tweeted that he had “spent the last few days on the phone calling Terra community members”.

“Builders, community members, employees, friends and family, that have been devastated by UST depegging… I am heartbroken about the pain my invention has brought on all of you,” he said.

“I still believe that decentralized economies deserve decentralized money – but it is clear that $UST in its current form will not be that money.”

He claimed that he or his companies did not profit from the bloodbath, nor did he sell any holdings in either currency during the crisis.

As a stablecoin, UST’s raison d’etre is to provide a place for investors to swap out their cryptocurrency holdings in a stable fashion compared with the volatility of other currencies.

However, unlike other stablecoins, it did not do so through holding traditional assets such as US dollars. As UST depegged from its supposedly stable $1 valuation, the Luna Foundation Guard (LFG) – in charge of maintaining the peg – deployed $1.5 billion worth of BTC last Monday to add liquidity to the ecosystem. It also loaned out coins to trading firms and 750 million UST tokens to accumulate BTC. The latter move has been criticised for having an inflationary impact.

Do Kwon tweeted at the time: “Deploying more capital – Steady lads.”

“We are currently working on documenting the use of the LFG BTC reserves during the depegging event. Please be patient with us as our teams are juggling multiple tasks at the same time,” his most recent thread continued.

“What we should look to preserve now is the community and developers that make Terra’s blockspace valuable – I’m sure our community will form consensus around the best path forward for itself, and find a way to rise again.”

He seemed to suggest a revival plan to hard fork the Terra blockchain at a previous moment in time and issue a percentage of tokens to holders.

Changpeng Zhao, CEO of crypto exchange Binance, tweeted that such a move simply “won’t work”.

Instead, he suggested that the community could use its Bitcoin reserves to buy back UST and ‘burn’ it to revive value.

He tweeted: “These past weeks have proven to be a watershed moment for the crypto industry. We have witnessed the rapid decline of a major project, which sent ripples across the industry, but also a new found resiliency in the market that did not exist during the last market downswing.

“Binance Labs invested in hundreds of projects over the last 4 years, including exchange ‘competitors’ and many ‘competing’ blockchains. A few of them have fallen by the wayside, but a few have been extremely successful. That’s how investments work.

“The last few days, we tried hard to support the Terra community. Minting, forking, don’t create value. Buying back, burning does, but requires funds. Funds that the project team may not have.

“In this regard, I would like to see more transparency from them. Much more! Including specific on-chain transactions (txids) of all the funds. Relying on 3rd party analysis is not sufficient or accurate. This is the first thing that should have happened.

“I am not always right, but my perspective is: Failures can/will happen. But when they do, transparency, speedy communication and owning responsibility to the community is extremely important.

“I am just hoping that the project teams can rise from the ashes and rebuild in a proper and sensible way. Regardless of my personal views, or the solution chosen in the end, we will always be here to support the community in any way we can.”