NFT marketplace Magic Eden has raised $130 million in Series B funding which values the company at $1.6 billion.

The round was co-led by Electric Capital and Greylock, while Lightspeed Venture Partners joined as a new anchor investor. Other participants include previous investors Paradigm and Sequoia Capital.

Funds from the Series B will be used to expand the company’s primary and secondary marketplaces, explore multi-chain opportunities, invest in the team as well as technology to enhance the user experience through improved insights, analytics, and trading tools.

Magic Eden’s goal is to support the next generation of digital creators and introduce a billion users to Web3.

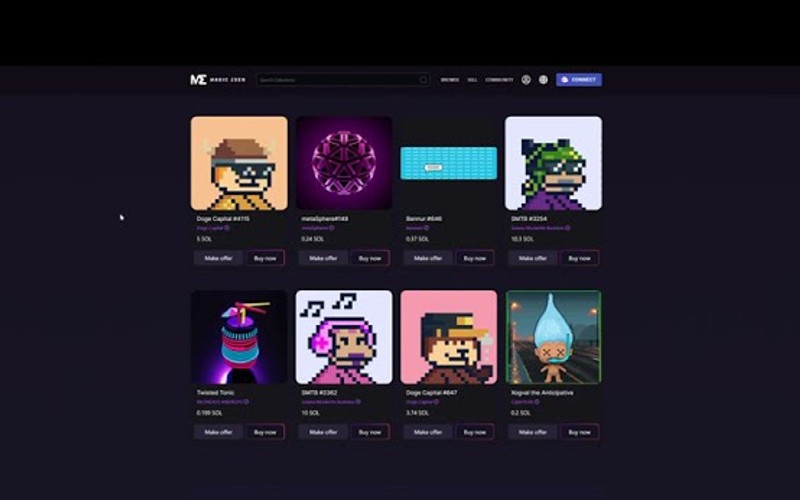

Launched in September 2021, Magic Eden claims to receive an average of 22 million unique sessions per month and see over 40,000 NFTs traded daily.

“We know that NFTs are the best way to bring people onto the blockchain,” said Jack Lu, CEO and co-founder. “NFTs are exciting, social, and cultural experiences that bring connectivity to the world.

“Since our inception, we’ve made the conscious decision to support both our creators and users through this tremendous era of growth for both the company and the industry. The best part is that we’re just getting started.”

Magic Eden’s Launchpad has launched 250 projects to date, while the company’s secondary market covers over 7,000 listed collections and sees over 92% of all NFT volume on Solana.

Zhuoxun Yin, COO and co-founder of Magic Eden, added: “We were the first to innovate in a number of areas: such as pairing NFT minting capabilities via Launchpad with a secondary marketplace, embedding gameplay with NFT games directly on the platform, and creating a Decentralized Autonomous Organization (DAO) to empower greater involvement within the Magic Eden community.

“We’re thrilled to have the continued support of our investors and community and look forward to delivering on Solana and beyond.”

Mike Duboe, partner at Greylock, said: “Magic Eden is one of those top 1% teams that is just firing on all cylinders – product execution, community growth, transaction volume – and the velocity in less than one year of existence has been exceptional.”