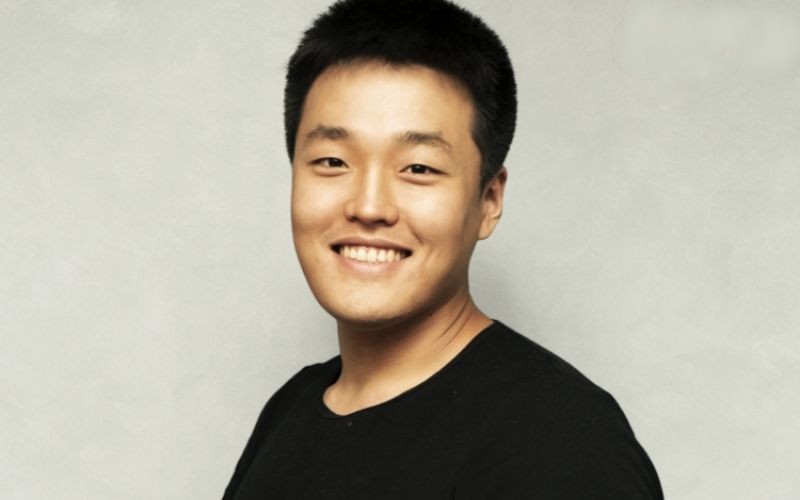

Do Kwon, co-founder of Terra, has been charged with fraud by the US Securities and Exchange Commission.

South Korea police and Interpol are hunting a figure whose current whereabouts are unknown.

The Terra ecosystem – which included the Luna cryptocurrency and algorithmic stablecoin TerraUSD (UST) – collapsed last year, leading to billions of losses for investors.

Regulator the SEC accused Kwon of “perpetuating a fraudulent scheme that led to the loss of at least $40 billion of market value”.

The suit added: “Terraform and Kwon also misled investors about one of the most important aspects of Terraform’s offering – the stability of UST, the algorithmic ‘stablecoin’ purportedly pegged to the US dollar.

“UST’s price falling below its $1 ‘peg’ and not quickly being restored by the algorithm would spell doom for the entire Terraform ecosystem, given that UST and LUNA had no reserve of assets or any other backing.”

When UST dropped 10 cents below $1, Kwon’s company Terraform Labs persuaded an unnamed US trading firm to buy UST to restore the peg, in exchange for Luna tokens.

“Almost immediately upon UST’s recovery in May 2021, Terraform and Kwon began to make materially misleading statements about how UST’s peg to the dollar was restored,” the suit said.

“Specifically, Terraform and Kwon emphasised the purported effectiveness of the algorithm underlying UST in maintaining UST pegged to the dollar – misleadingly omitting the true cause of UST’s re-peg: the deliberate intervention by the US trading firm to restore the peg.”

SEC director of enforcement Gurbir Grewal said the project “was neither decentralised, nor finance… it was simply a fraud propped up by a so-called algorithmic ‘stablecoin’ – the price of which was controlled by the defendants, not any code”.

The complaint also alleges that Kwon and Terraform falsely told their customers that Chai, the Korean electronic mobile payment app, used the Terraform blockchain to process payments.