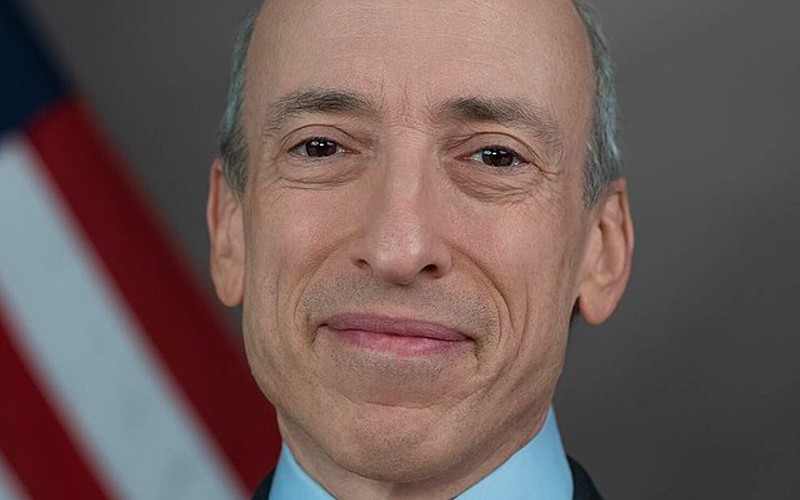

The chair of the United States Securities and Exchange Commission has said that every cryptocurrency except for Bitcoin should be considered as a security.

Gary Gensler told New York Magazine that projects “are securities because there’s a group in the middle and the public is anticipating profits based on that group”.

This would bring them under its remit.

The news was welcomed by MicroStrategy co-founder and executive chairman Michael Saylor, a well-known Bitcoin maximalist.

“Consensus is building that everything in the #Crypto industry other than #Bitcoin is a security, destined to be regulated by the SEC,” he tweeted. “This makes BTC the only crypto-asset suitable for use as global money.”

However Jake Chervinsky, a lawyer and policy lead at Blockchain Association, indicated that to follow through on this would be impractical for the SEC.

“Chair Gensler may have prejudged that every digital asset aside from bitcoin is a security, but his opinion is not the law,” he tweeted.

“The SEC lacks authority to regulate any of them until and unless it proves its case in court. For each asset, every single one, individually, one at a time.”

Gabriel Shapiro, general counsel at investment firm Delphi Labs, said that if Gensler had his way, more than 12,300 tokens – worth around $663 billion – would become illegal.

“SEC registration is not only too expensive for most token creators — there is also no clear path for registration of tokens,” he tweeted.

“What is the plan here? Since registration is not feasible, it can only be everyone pays huge fines, stops working on the protocols, destroys all dev premines, and delists from trading. That would mean 12,305 lawsuits.

“What is the plan? We are all wondering, and billions of American [dollars] are at risk.”