The founders of bankrupt cryptocurrency hedge fund Three Arrows Capital are reportedly looking to launch a trading platform.

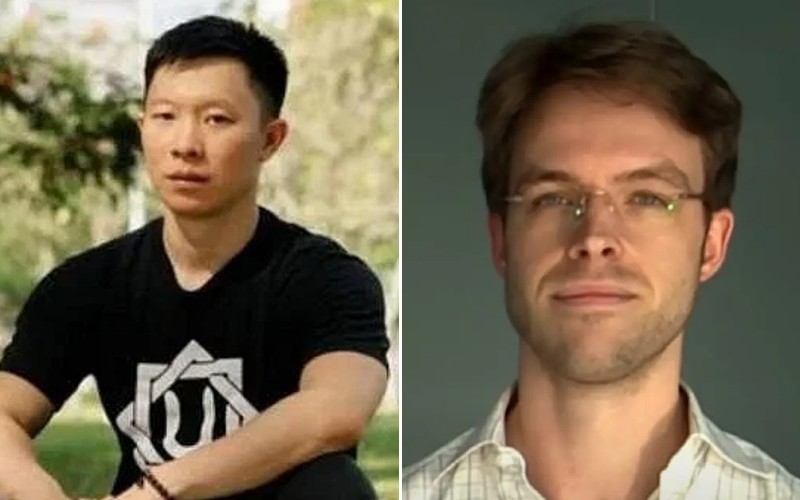

Su Zhu and Kyle Davies have reportedly partnered with Coinflex co-founders Mark Lamb and Sudhu Arumugam for GTX, which aim to capitalise on large numbers of creditors of collapsed exchanges, helping them to recover holdings and use them for trading.

According to a pitch deck sent to several media outlets, the startup – which already has a C-suite in place and more than 60 developers – wants to raise $25 million to launch before the end of February at the latest.

The deck says the ‘distressed debt marketplace’ is looking to appeal directly to the more than one million FTX depositors that are now involved in a bankruptcy proceeding.

It cites a “clear need to unlock” the claims market, which it values at $20 billion. The pitch argues that the platform could fill a “power vacuum left by FTX”.

Singapore-based 3AC, once worth $10 billion, filed for bankruptcy in July 2022. The crypto market price plunge caused losses which left it unable to repay lenders.

Advisors working to liquidate 3AC served Davies and Zhu a subpoena over Twitter last week, claiming that their whereabouts were still unknown.