Binance has committed $1 billion to prop up the crypto industry following the collapse of rival exchange FTX.

The initial commitments to a recovery fund may increase to $2bn later “if the need arises”, according to the company.

It has also received $50 million in commitments from investment firms including Jump Crypto, Polygon Ventures and Animoca Brands.

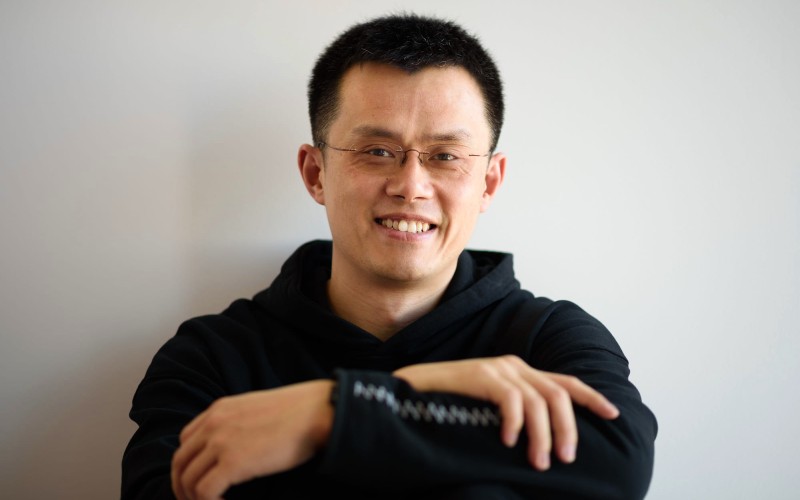

The public wallet address containing its initial commitment – in its own BUSD stablecoin – was shared by Binance CEO Changpeng Zhao.

“We do this transparently,” he wrote.

It is intended as a support fund for projects that are facing financial difficulties, Binance said, and not as a traditional investment vehicle.

Expected to last around six months, it has already received around 150 applications.

The irony of Binance emerging as a ‘white knight’ for the industry is that FTX itself played that role amid the crypto winter – investing in a number of ailing firms – prior to its bankruptcy.

Zhao served as a trigger for the demise of FTX by highlighting concerns over its holdings and liquidity, leading to a ‘bank run’ of users looking to withdraw their funds which it could not honour.

Meanwhile the CEO has confirmed that the exchange’s US arm will make a fresh bid for bankrupt crypto lender Voyager now that FTX is unable to follow through with acquiring it.